How Much Does it Cost to File Taxes with TurboTax

April 12, 2023The dreaded task of filing taxes is upon us all. Especially for young people just getting started, having to budget and try to pay down debt at the same time can be nearly impossible. Many people turn to free online tax programs that they probably won’t use again. In reality, there are several steps that can be taken in order to get your taxes done right the first time while saving some money too.

What is the cost of filing taxes with TurboTax?

TurboTax is a popular tax software that allows users to file their taxes online. The cost of filing taxes with TurboTax varies depending on the type of return you are filing. For a federal return, the cost is $49.99 for a basic return, $79.99 for a deluxe return, and $119.99 for a premium return.

How much does it cost to file your taxes with TurboTax?

TurboTax is a popular online tax preparation and filing service that charges a fee for its services. The cost of filing your taxes with TurboTax varies depending on the version of the software you use and the complexity of your tax return.

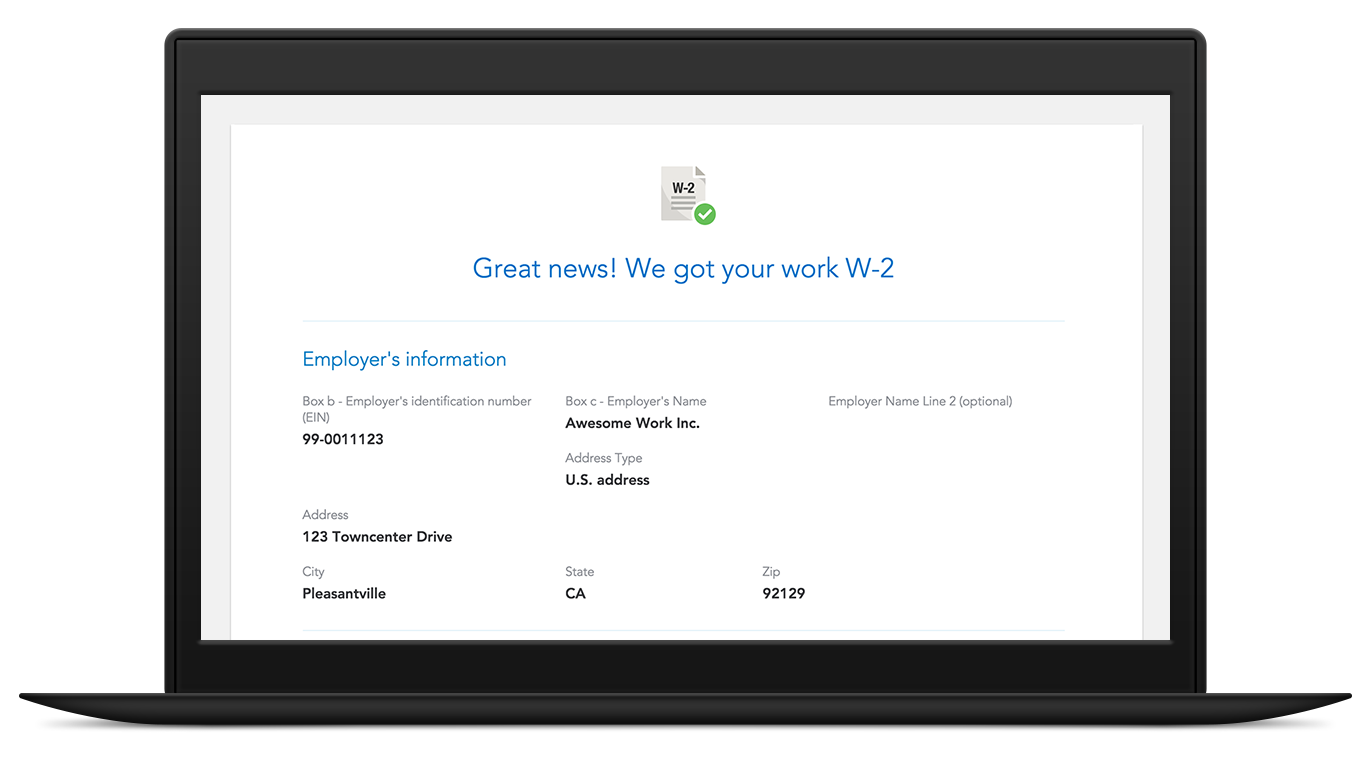

How to file taxes for free with TurboTax

TurboTax is a program that helps you file your taxes for free. It is easy to use and can help you get the most money back from the government.

What are the costs of TurboTax filing?

TurboTax is a popular tax preparation software that allows users to file their taxes online. The software is available for a fee, and there are also additional costs associated with filing taxes using TurboTax.

How much does it cost to e-file taxes with TurboTax?

TurboTax is a popular tax preparation software that allows you to e-file your taxes. The cost to e-file with TurboTax varies depending on the version you choose. The most basic version, TurboTax Free, is free to use, but you cannot e-file your taxes with it.

How much does TurboTax cost for the average person?

TurboTax is a program that helps you file your taxes. It is available for a fee, and the amount you pay depends on the version you choose.

How much does TurboTax cost for a business?

TurboTax is a tax preparation software that can be used for both personal and business taxes.

How much does TurboTax cost for a family?

TurboTax is a software program that helps people prepare and file their taxes. The cost of TurboTax varies depending on the version that you purchase. The basic version costs $49.99, while the deluxe version costs $79.99. If you need to file a state tax return, the cost is an additional $39.99. If you have a family, the cost of TurboTax increases.

How much does TurboTax cost for a single person?

TurboTax is a tax preparation software that makes it easy for you to file your taxes.

How much does TurboTax cost for a student?

TurboTax is a tax preparation software that is designed to help you file your taxes. It is available for both Windows and Mac, and there is a free version and a paid version. The paid version costs $59.99 for a single return or $119.99 for a return with state filing.

How much does TurboTax cost for a senior citizen?

TurboTax is a software application that helps taxpayers prepare and file their tax returns. The company offers a range of products, including a free version and a version that costs $59.99.

How much does TurboTax cost for a veteran?

TurboTax is a program that helps taxpayers file their taxes. It is available for a free download, or for purchase.

Is TurboTax free to file?

TurboTax is a popular software program used to file taxes. It is often advertised as being free to file, but there are some restrictions. In order to qualify for the free filing, the user’s income must be below a certain amount.

TurboTax is a popular tax preparation software that allows users to file their taxes online. Depending on the type of return you are filing, the cost of filing your taxes with the software can vary. For a federal return, the cost is $49.99 for a basic return or $79.99 for a more complex return.