What to Know About When Does W2 Come Out

April 12, 2023With any business, one of the biggest concerns is taxes. When does W2 come out and how can you find this information? There are many factors to consider when determining your tax liability for a year. The bigger you get with your business, and the more employees you have, keeping track of tax info is only going to be more important. Here are some basic pointers about what to expect when do W2 come out.

What is the W2 form?

The W2 form is a document that employers must provide to their employees, which lists the wages earned and taxes withheld from those wages during the year.

When do I receive my W2 form?

You should receive your W2 form by January 31. If you don’t receive it by this date, check with your employer to make sure it hasn’t been sent to the wrong address.

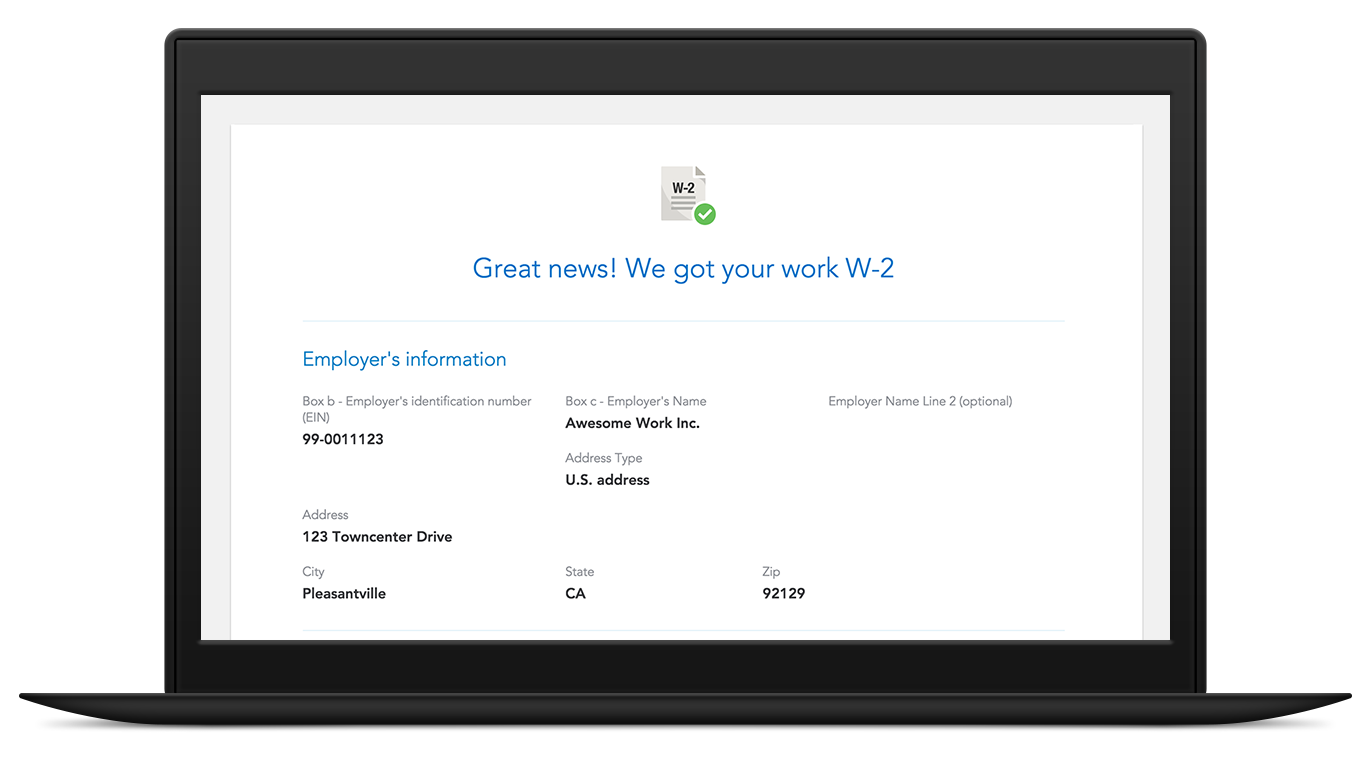

How can I get a copy of my W2 online?

To get a copy of your W2 online, you can visit the IRS website and use the “Get a Transcript” tool. You will need to provide your name, Social Security number, date of birth, and address.

How to request a W2 from a previous employer?

If you need a W2 from a previous employer, you can request one by contacting the company’s payroll or human resources department. Call their toll-free number, or you can write them a letter asking for the W2. If you use the W2 request as an opportunity to ask questions about your current job, your employer may provide you with the W2 immediately.

What information is included on a W2 form?

A W2 form is a document that lists an employee’s wages and the taxes that have been withheld from them over the course of the year. It is provided by your employer at the end of the tax year to ensure that the correct amount of income tax is withheld from your paycheck.

What should I do if I have not received my W2?

If you have not received your W2, you should contact your employer to inquire about the status of your W2. If you have not been paid via W2 withholding, you will need to fill out a tax return and pay any back taxes that may have been due along with any penalties that may have been assessed.

What are the penalties for not filing a W2?

There are a number of potential penalties for not filing a W2. The most severe is a prison sentence, but other penalties can include fines and being barred from doing business with the government.

What to do if you’ve lost your W2

If you have lost your W2, you should contact your employer as soon as possible to request a new copy. If you do not receive a response within 30 days, you should contact your state’s unemployment office to see if you are eligible for an electronic W2.

How to get a copy of your W2

To get a copy of your W2, you can either call the IRS at 1-800-829-1040 or go to the IRS website and use the “Get Transcript”

When can you find out when W2 comes out? It’s important to consider all the factors that go into your tax liability for the year. A W2 form is a document that lists an employee’s wages and the taxes that have been withheld from them over the course of the year.